Bitcoin surged to an all-time high above $112,000 this week, buoyed by a wave of reawakened whale wallets and increasing institutional flows. The renewed on-chain activity is reviving bullish sentiment, and some forecasts suggest BTC could hit $150,000 by year-end.

The world’s largest cryptocurrency climbed more than 18% since the start of 2025, pushing its market capitalization to $2.21 trillion. As of mid-July, BTC was trading near $111,100 amid elevated daily volumes of approximately $59.4 billion.

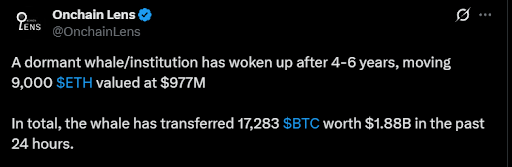

A series of high-value transactions by dormant holders has added fuel to the current rally. On-chain data reveals that a long-inactive wallet moved 17,283 BTC valued at roughly $1.88 billion within a single 24-hour window.

Source: OnchainLens

Last week, two Satoshi-era wallets transferred a combined 20,000 BTC for the first time in 14 years, stoking market speculation over long-term holder behavior.

Further inflows came from the Royal Government of Bhutan, which sent over 350 BTC (around $38.5 million) to Binance in the past 10 days. The transactions highlight the growing involvement of sovereign entities in Bitcoin’s capital flows and may suggest strategic liquidity operations or asset diversification.

Source: Arkham explorer

Technical Picture Signals More Upside: The Road to $150,000

Despite the sharp price appreciation, technical indicators suggest the rally still has legs. The Relative Strength Index (RSI) is currently at 63.62, a level that indicates strength without crossing into overbought territory. The MACD has printed a bullish crossover at 172.51, typically viewed as a buy signal, while the 10-day simple moving average remains above the 100-day—a classic indication of short-term momentum.

Still, some caution is warranted in the near term. The stochastic oscillator has risen to 86.46, a reading often associated with interim consolidation. Analysts flag resistance levels at $117,498 and $127,279 as potential inflection points. Failure to breach these levels decisively could trigger profit-taking.

Sentiment among institutional investors continues to improve, helped by accommodative macro conditions, steady ETF inflows, and concerns over traditional fiat debasement. Analysts at cryptona.co see $150,000 as a realistic price target for Bitcoin in the coming months provided that $117K is broken with volume support.

Key tailwinds include expectations of Federal Reserve rate cuts, further sovereign adoption, and rising demand for digital assets in inflation-hedging portfolios.

Bottom Line

Bitcoin’s breakout above $112,000 reflects both deepening institutional engagement and a pivotal shift in long-term holder behavior. While short-term corrections remain likely, technical and fundamental structures align toward further appreciation. The $150,000 target may no longer be speculative, as it’s increasingly becoming the market’s base case.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Zoomer Zest journalist was involved in the writing and production of this article.